America sacrificed equity for the false promise of efficiency and growth, and society is now more unequal than at any time since the early part of the last century.

America sacrificed equity for the false promise of efficiency and growth, and society is now more unequal than at any time since the early part of the last century.Many economists worry that making societies more equal through income redistribution or other means reduces economic growth.

For example, the Bush tax cuts were justified, in part, by the assertion that equity had overshadowed efficiency in tax policy. Taxes on the wealthy, and the inefficiencies that come with them, were much too high, it was argued, and lowering taxes would cause output to go up enough to lift all boats substantially.

Accordingly, the lower end of the income distribution would fare much better after income trickled down than it would under redistributive policy.

The economy did grow after the Bush tax cuts, but the rate of growth was unremarkable, especially for jobs, and there's little evidence that they caused large increases in output growth, as promised.

The economy did grow after the Bush tax cuts, but the rate of growth was unremarkable, especially for jobs, and there's little evidence that they caused large increases in output growth, as promised.In fact, there's little evidence that the Bush tax cuts had any effect at all. The trade-off simply wasn't there.

And the tax cuts at the upper end of the income distribution did nothing to correct for the fact that although worker productivity was rising, wages remained flat -- a problem that began in the mid-1970s.

This was an indication that something was amiss in the mechanism that distributes income to different members of society. Workers were helping to increase the size of the pie, but income did not trickle down, and their share of the pie was no larger than before.

While some argue that those at the top of the income distribution earn every cent they receive, and hence deserve to keep all of it, there is plenty of evidence that the compensation of financial executives, CEOs of major corporations and others at the top of the pyramid far exceeds the value of what they contribute to society.

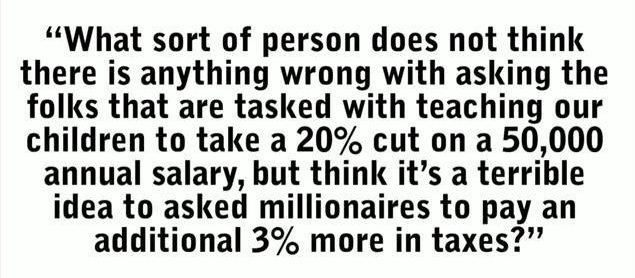

If those at the top of the income distribution receive far more than the value of what they create, and those at lower income levels receive less, then one way to correct this is to increase taxes at the upper end of the income distribution and use the proceeds to protect important social programs that benefit working-class households, programs that are currently threatened by budget deficits.

If those at the top of the income distribution receive far more than the value of what they create, and those at lower income levels receive less, then one way to correct this is to increase taxes at the upper end of the income distribution and use the proceeds to protect important social programs that benefit working-class households, programs that are currently threatened by budget deficits.This would help to rectify the maldistribution of income that is preventing workers from realizing their share of the gains from economic growth.

We face a choice between cutting key benefits for the middle class and creating an ever more unequal society, or raising taxes on the wealthy to preserve the social programs that lower-income households rely upon.

We hear that raising taxes is unfair and that tax increases will harm economic growth. But there's nothing unfair about correcting the maldistribution of income that we've seen in recent decades, or about making sure the burden from paying taxes is more equitable than it is now.

Rick, All I can say is sooner or later something has to give, and I'm tired of doing it. I will send this out to about 100 people, I think everyone should be doing the same. The power is with the people

ReplyDeleteBamBam - I hope things change sooner rather than later. At least this Occupy movement has caused a stir.

ReplyDeleteI hope somethings done soon...

ReplyDeleteKarl - I have little faith that major change will happen. But I'm hopeful.

ReplyDeleteLOOOOOOVE that George Carlin saying - and really miss that guy!

ReplyDeleteGreg - He was great!

ReplyDelete